How cloud scalability is seducing the financial sector

Cloud Computing News | May 14, 2018

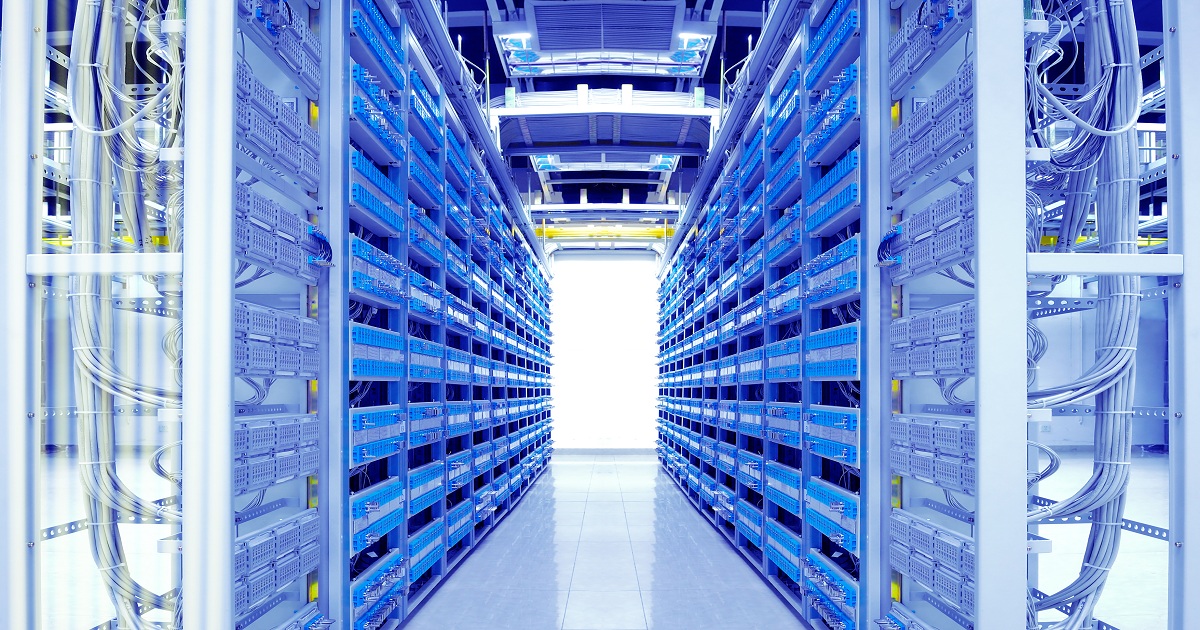

The financial sector, while forging ahead in other areas of digital transformation, has been relatively slow to adopt the cloud and there has been good reason for it: banks have to deal with highly sensitive data and sharing data storage and compute resources with others could not even be envisaged, let alone adopted. However, just under two years ago, the Financial Conduct Authority (FCA) published a new guidance for firms outsourcing to the ‘cloud’ and other third-party IT services which paved the way for banks, insurers and other financial services companies to take advantage of cloud computing services. In this new guidance, the regulator outlined that there was no fundamental reason why cloud services (including public cloud services) couldn’t be implemented, subject to compliance with specific guidance for financial firms outsourcing to the cloud and other third-party IT services. According to Celent, financial services firms will progressively abandon private data centres and triple the amount of data they upload to the cloud in the next three years. Because of the huge and increasing amounts of data financial services firms need to manage, the scalability of cloud has become an attractive feature – especially considering the fact that the number of daily transactions can stretch into the millions. On top of that, the volume of transactional data is not always predictable, so financial institutions must be able to scale up quickly on demand.